Corporate Governance

Basic Approach

NSD’s basic approach to corporate governance is to earn the trust of our shareholders and investors by applying the principles and provisions of our Management Philosophy and Basic Management Policy towards accelerating decision-making, clarifying management responsibilities, enhancing and strengthening our compliance structure, and by engaging in timely and appropriate information disclosure. We believe that a firm corporate governance structure is the foundation that will enable us to secure appropriate profits and make sustainable increases to our corporate value.

Corporate Governance Structure

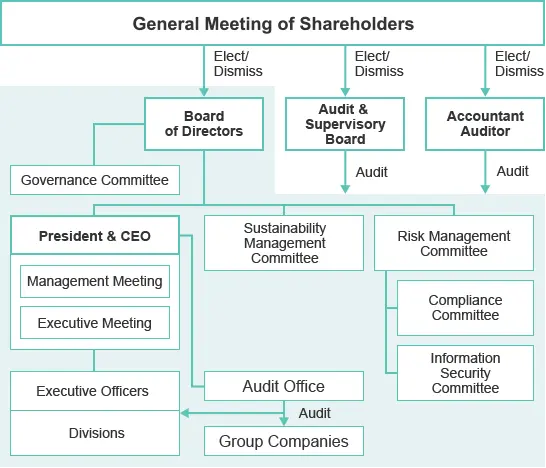

NSD has adopted an Audit & Supervisory Board structure. In addition to the General Meeting of Shareholders and directors, our corporate bodies include Board of Directors, Audit & Supervisory Board, Audit & Supervisory Board members, and accounting auditors. We also have established various committees, including a Governance Committee as an advisory body to the Board of Directors, a Management Meeting and Executive Meeting as deliberation bodies for the President & CEO, and various committees such as Sustainability Management Committee and Risk Management Committee subordinate to the Board of Directors.

To accelerate decision-making by the Board of Directors and strengthen auditory functions, we also have adopted an executive officer system to promote dynamic business execution. This system is practical for our Group since our Group business domains do not branch into various sectors and because this system will enable us to build an effective and efficient governance structure that is ideal for our business scope. In addition to Audit & Supervisory Board member functions, we also have appointed multiple outside directors to strengthen and enhance management monitoring functions.

Board of Directors

The Board of Directors is comprised of seven directors, of which three are outside directors. The Board of Directors convenes, as a general rule, at least once per month to decide on important matters related to management and business execution, as well as to monitor the status of the execution of duties by each director. Board of Directors meetings are attended by three Audit & Supervisory Board members, who confirm the legality of decision making and the execution of duties by directors.

Audit & Supervisory Board and Audit & Supervisory Board members

The Audit & Supervisory Board is comprised of one full-time Audit & Supervisory Board member and two outside Audit & Supervisory Board members. The Audit & Supervisory Board members audit the status of the execution of duties by directors and the internal controls system by attending Board of Directors meetings and other important meetings as well as by examining the status of business and assets. The Audit & Supervisory Board determines audit policy and the division of duties for Audit & Supervisory Board members, and holds regular meetings to discuss the audit results of each Audit & Supervisory Board member.

Governance Committee

We have established a Governance Committee as an advisory body to the Board of Directors to ensure fairness, transparency, and objectivity in decision-making conducted by the Board of Directors. The Governance Committee is chaired by the President & CEO, and is comprised of a total of four members: the President & CEO and three outside directors. The Committee provides advice and recommendations to the Board of Directors based on deliberations of various matters, including the nomination and removal of directors and Audit & Supervisory Board members and remuneration systems for directors, and decides on matters delegated by the Board of Directors.

Management Meeting and Executive Meeting

We have established a Management Meeting and Executive Meeting as deliberation bodies for the President & CEO.

The Management Meeting is chaired by the President & CEO, and is comprised of a total of eight members: seven directors (including three outside directors), and the full-time Audit & Supervisory Board member. The Management Meeting convenes at least one per month to deliberate and report on important matters related to management, including management plans and management strategies.

The Executive Meeting is chaired by the President & CEO, and are comprised of a total of 12 members: seven directors (including three outside directors), the full-time Audit & Supervisory Board member, and four executive officers. The Executive Meeting is convened at least one per month to deliberate and report on important matters related to business execution, including budget creation and the status of implementation.

Various committees

We have established a Sustainability Management Committee and a Risk Management Committee that is subordinate to the Board of Directors. As committees subordinate to this Risk Management Committee, we also have established a Compliance Committee and an Information Security Committee.

- (a) Sustainability Management Committee

The purpose of the Sustainability Management Committee is to tackle SDGs / ESG initiatives across the organizations. The Committee is chaired by the President & CEO, and is comprised of related officers and department managers.

- (b) Risk Management Committee

The purpose of the Risk Management Committee is to conduct Group risk management. The Committee is chaired by the President & CEO, and is comprised of related officers, including the officer in charge of internal controls, as well as department managers.

- (c) Compliance Committee

The purpose of the Compliance Committee is to respond to compliance violations and draft prevention measures. The Committee is chaired by the President & CEO, and is comprised of related officers and Department Managers.

- (d) Information Security Committee

The purpose of the Information Security Committee is to outline Group security measures and information security policy. The Committee is chaired by Head of Corporate Service Division, and is comprised of related officers and department managers.

| Name | Title of Representative | Board of Directors | Audit & Supervisory Board | Governance Committee | Management Meeting | Executive Meeting | Sustainability Management Committee | Risk Management Committee | Compliance Committee | Information Security Committee |

|---|---|---|---|---|---|---|---|---|---|---|

| Yoshikazu Imajo | President & CEO | ◎ | ◎ | ◎ | ◎ | ◎ | ◎ | ◎ | ||

| Hideshi Maekawa | Director, Senior Managing Executive Officer | ○ | ○ | ○ | ○ | ○ | ○ | ◎ | ||

| Osamu Yamoto | Director, Senior Managing Executive Officer | ○ | ○ | ○ | ○ | ○ | ○ | |||

| Hidetaka Kikawada | Director, Managing Executive Officer | ○ | ○ | ○ | ○ | ○ | ○ | |||

| Atsuhiro Kawamata | Director (Outside) | ○ | ○ | ○ | ○ | |||||

| Kumiko Jinnouchi | Director (Outside) | ○ | ○ | ○ | ○ | |||||

| Toru Takeuchi | Director (Outside) | ○ | ○ | ○ | ○ | |||||

| Kiyoshi Kondo | Audit & Supervisory Board Member | ○ | ◎ | ○ | ○ | |||||

| Kunio Kawa | Audit & Supervisory Board Member (Outside) | ○ | ○ | |||||||

| Chieko Nishiura | Audit & Supervisory Board Member (Outside) | ○ | ○ | |||||||

| Satoshi Kiyota | Managing Executive Officer | ○ | ○ | ○ | ○ | |||||

| Atsuji Kobayashi | Managing Executive Officer | ○ | ○ | ○ | ○ | |||||

| Akio Shinno | Managing Executive Officer | ○ | ○ | ○ | ○ | |||||

| Related Executive Officers and Department Managers | ○ | ○ | ○ | ○ | ○ | |||||

| Name | Corporate Management | IT | Legal & Compliance | Finance & Accounting | Global Business | |

|---|---|---|---|---|---|---|

| Directors | Yoshikazu Imajo | ○ | ○ | ○ | ○ | ○ |

| Hideshi Maekawa | ○ | ○ | ○ | ○ | ○ | |

| Osamu Yamoto | ○ | ○ | ||||

| Hidetaka Kikawada | ○ | ○ | ○ | |||

| Atsuhiro Kawamata | ○ | ○ | ○ | ○ | ||

| Kumiko Jinnouchi | ○ | ○ | ○ | |||

| Toru Takeuchi | ○ | ○ | ○ | ○ | ||

| Audit & Supervisory Board Members | Kiyoshi Kondo | ○ | ○ | ○ | ||

| Kunio Kawa | ○ | ○ | ○ | |||

| Chieko Nishiura | ○ | ○ |

Reasons for Appointment as Outside Director and Main Activities

Outside directors

| Name | Reasons for appointment | Activities during FY2022 | |

|---|---|---|---|

| Atsuhiro Kawamata (Independent Officer) | Mr. Atsuhiro Kawamata has extensive experience, great insight into management, and capability of supervision gained in Japan and overseas as a member of management of Japan Tobacco, Inc. (including TableMark Co., Ltd.). The Company believes that its corporate governance will be further reinforced with his advice for the Board of Directors and the Governance Committee from an objective, extensive and highly professional viewpoint leveraging his experience and insight. | Mr. Kawamata has helped to further strengthen the Company’s corporate governance by utilizing his extensive experience, great insight into management, and capability of supervision gained in Japan and overseas in his management roles in the manufacturing industry to provide advice concerning operations and overall management at meetings of the Board of Directors and officer personnel moves and remuneration at Governance Committee meetings. |

|

| Kumiko Jinnouchi (Independent Officer) | Ms. Kumiko Jinnouchi has extensive experience and specialized expertise in all aspects of legal affairs as an attorney-at-law. The Company believes that its corporate governance will be further reinforced with her advice for the Board of Directors and the Governance Committee from an objective, extensive and highly professional viewpoint leveraging her experience and insight. | Ms. Jinnouchi has helped to further strengthen the Company’s corporate governance by utilizing her extensive experience and specialized expertise in all aspects of legal affairs as an attorney-at-law to provide advice concerning operations and overall management at meetings of the Board of Directors and officer personnel moves and remuneration at Governance Committee meetings. |

|

| Toru Takeuchi (Independent Officer) | Mr. Toru Takeuchi has extensive experience, great insight into management, and capability of supervision gained in Japan and overseas as a member of management of Nitto Denko Corporation. The Company believes that its corporate governance will be further reinforced with his advice for the Board of Directors and the Governance Committee from an objective, extensive and highly professional viewpoint leveraging his experience and insight. | Mr. Takeuchi has helped to further strengthen the Company’s corporate governance by utilizing his extensive experience, great insight into management, and capability of supervision gained in Japan and overseas in his management roles in the manufacturing industry to provide advice concerning operations and overall management at meetings of the Board of Directors and officer personnel moves and remuneration at Governance Committee meetings. |

|

Outside Audit & Supervisory Board members

| Name | Reasons for appointment | Activities during FY2022 | |

|---|---|---|---|

| Kunio Kawa | Mr. Kunio Kawa has extensive experience, great insight into management, and capability of supervision gained as a member of management and as a corporate auditor of Mitsubishi Gas Chemical Company, Inc. The Company believes that its corporate governance will be further reinforced with his advice for the Board of Directors and the Audit & Supervisory Board from an objective, extensive and highly professional viewpoint leveraging his experience and capability of supervision. | Mr. Kawa has helped to further strengthen the Company’s corporate governance by utilizing his extensive experience, great insight into management, and capability of supervision gained as a member of management and as a corporate auditor in the manufacturing industry to provide advice concerning operations and overall management at meetings of the Board of Directors and the Audit & Supervisory Board. |

|

| Chieko Nishiura | Ms. Chieko Nishiura has extensive experience and specialized knowledge of general accounting.The Company believes that its corporate governance will be further reinforced with her advice for the Board of Directors and the Audit & Supervisory Board from an objective, extensive and highly professional viewpoint leveraging her experience and insight. | Appointed in FY2023 | |

Officer Remuneration

Policy and details of director remuneration

The remuneration of NSD’s directors is calculated based on the roles and responsibilities of each position, while also emphasizing links with performance in order to strengthen the incentive for enhancing the Company’s performance. Therefore, director remuneration consists of base remuneration as fixed remuneration, bonus as short-term incentive-based remuneration, and stock remuneration as medium- to long-term incentive-based remuneration. The ratio of incentive-based remuneration to total remuneration of each individual director is at least 40%.

However, outside directors, who occupy a position of independence from business execution and who are responsible for the supervision of management, only receive base remuneration, which is fixed remuneration, because incentive-based remuneration is not suited to their role.

Base Remuneration

Base remuneration is paid monthly as fixed remuneration for the performance of duties.

Base remuneration is paid according to the base remuneration table following the roles and responsibilities of each position.

Bonus

Bonuses are paid annually as short-term incentive-based remuneration for achieving the business plan for each fiscal year.

Bonuses are calculated by reflecting the performance and qualitative evaluation results in the standard bonus amount prescribed by position following the bonus calculation standards.

Performance evaluations use net sales, operating profit, ordinary profit and net profit (consolidated basis) as financial indicators for appropriately reflecting performance in each year under evaluation. The ratio calculated based on the rate of achievement of these targets is used as an evaluation indicator. Qualitative evaluations consider the directors’ roles, implementation of responsibilities, and their activities for the year under evaluation that cannot be assessed using financial indicators.

Stock Remuneration

Stock remuneration provides an incentive for continuously enhancing the Company’s corporate value and promotes shared value between directors and shareholders. It comprises restricted shares issued annually per the following conditions as medium- to long-term incentive-based remuneration.

- Transfer Restriction Period and Lifting of Restriction

The transfer restriction period spans from the date of issuance to the date of resignation or retirement from the positions of director, executive officer, or equivalent (hereinafter referred to as "Officer"). The transfer restriction shall be lifted at the expiration of the transfer restriction period, provided that the person continues to hold the position of Officer during the restriction period.

- Acquisition Without Consideration

In case an Officer resigns or retires from the position of Officer without justifiable reason, or commits an act that significantly damages the social credibility of the Company during the transfer restriction period, the Company will acquire all of the restricted shares without consideration. Provided, however, that in case an Officer resigns or retires from the position of Officer due to death or other reasons deemed legitimate by the Board of Directors, the timing and number of shares for which to lift the transfer restriction will be reasonably adjusted.

The number of shares to be issued is calculated based on the stock remuneration threshold amount determined according to position held and the closing price of the Company's common stock on the business day preceding the resolution of the Board of Directors regarding the allocation of shares. Provided, however, that the total number of shares to be issued to directors shall be 40,000 shares or less per year. In case of a stock split or consolidation that requires adjustment of the total number of shares, the total number will be reasonably adjusted.

Procedures for approving director remuneration

The details and procedures for approving director remuneration are stipulated in the Policy on Remuneration for Directors and Executive Officers. This policy is determined by the Board of Directors based upon deliberations held at the Governance Committee.

The Governance Committee, entrusted by the Board of Directors, approves the basic remuneration table, bonus calculation standards and standard bonus amount, and stock remuneration threshold amount based on this policy.

With regard to bonuses, executive directors conduct performance and qualitative evaluations of those eligible for payment through consultation, and formulate a plan for the amount of bonuses for each individual. The Governance Committee verifies the appropriateness of this individual-specific payment proposal and resolves the total amount of payment at meetings of the Board of Directors.

| Category | Payment amount (thousands of yen) | Total amount for each type of remuneration (thousands of yen) | Number of recipients (persons) | ||

|---|---|---|---|---|---|

| Fixed remuneration | Performance-linked remuneration | Non-monetary remuneration | |||

| Directors (Outside directors) | 196,320 (25,200) | 122,700 (25,200) | 57,000 (—) | 16,620 (—) | 7 (3) |

| Audit & Supervisory Board members (Outside Audit & Supervisory Board members) | 28,800 (13,200) | 28,800 (13,200) | — (—) | — (—) | 4 (3) |

| Total | 225,120 | 151,500 | 57,000 | 16,620 | 11 |

- *1Director remuneration does not include salary paid to directors who serve concurrently as employees.

- *2Fixed remuneration is the amount of base remuneration paid during the fiscal year ended March 31, 2022, performance-linked remuneration is the amount of bonus with the fiscal year as an eligible period, and non-monetary remuneration is the amount of stock remuneration incurred as an expense during the fiscal year.

- *3As of March 31, 2023, there are seven directors (three of whom are outside directors) and three Audit & Supervisory Board members (two of whom are outside Audit & Supervisory Board members). The number of recipients differs from the number of officers as of March 31, 2023 because it includes one Audit & Supervisory Board Member who retired due to expiration of his term of office at the conclusion of the 53rd Ordinary General Meeting of Shareholders held on June 24, 2022.